One loan might get one into trouble if they do not pay sufficient attention to getting it back in a timely matter, therefore, it is superfluous to highlight that multiple loans require additional planning and careful distribution of monthly earnings. At some points, one has rarely other options than to consider taking additional loans in order to make amends for bad choices they have made and irresponsible financial moves that have led to a financial dead end.

On the other hand, acquiring debt consideration loans might financially burden your budget and cause you additional problems if you do not deploy newly acquired funds ideally. Thus, read the potential pros and cons of debt consideration loans and figure out whether drawing this type of financial move would bring you any good.

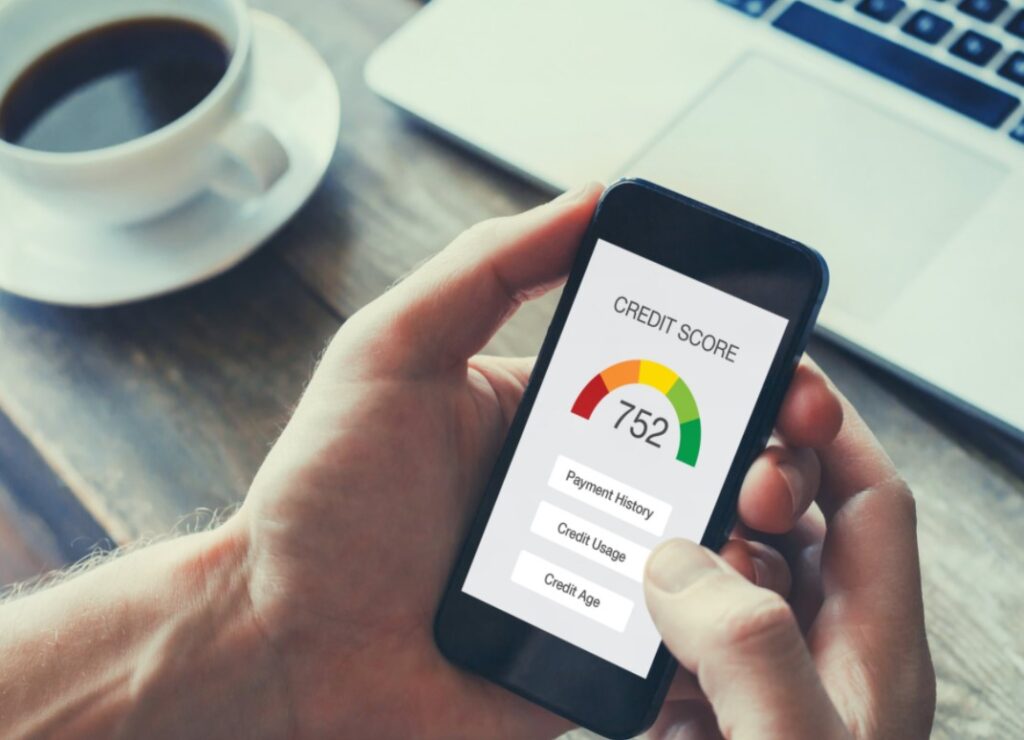

1. Lift Your Credit Rating

You are probably aware that going deeper into debt will affect the credit score negatively, but when taking a debt consolidation loan is in question, the chances it will go up as soon as you pay up some of your late payments are huge. For your consideration, payment history makes a bit more than one-third of your credit score, so it is obvious that you will make a noticeable jump on the scale if you carefully utilize newly acquired funds.

Unfortunately, the fact that you take a debt consolidation loan means nothing by itself, moreover, it is up to how you devise your financial plan, and how you carry it into effect. Do bear in mind that the credit rating does not have a will on its own, but strictly depends on how seriously you commit yourself to pay both old and new financial commitments.

Thus, we advise you to assess every potential option thoroughly before rushing into making hasty financial moves that might cause you more harm than good. If you decide to borrow extra funds, you might do it in accordance with your financial capabilities, since the pretentious state of mind when debt consolidation loans are concerned are usually associated with unsatisfactory outcomes.

2. Financial Injection

In a nutshell, debt consolidation loans imply you require an additional loan in order to combine all the previous debts under one major debt you would pay back under newly established dynamics. Another option to get out of debt is to sell your life insurance policy through sites like harborlifesettlements.com. This is a great way to gain access to cash in order to pay off current debt.

On the other hand, if you bite more than you can swallow, the chances you are doing yourself an ill turn that will only help on your way to financial rock bottom are major! In other words, opt for this type of loan solely if it will bring you good, and what might help you resolve whether it would be a positive financial move to take a loan or not is asking for a professional piece of advice.

Credit Associates BBB might assist you with additional pieces of information on how to make the most out of your current situation and establish which type of financial injection would be the most suitable for your cause.

3. Interest Rates

Individuals of different backgrounds often opt for debt consolidation loans because they cannot keep up with the tempo imposed by high interest rates. Since every single case has its debt history it is hard to present a unique model that could be used to resolve contrasting financial dead-ends.

On one hand, careful selection of a particular model of debt consolidation loan might put you into a position to pay smaller fees and interest rates than was the case in the past. That would imply you scoring a tailored loan that completely covers your debts to date and manipulating further debt payments to go hand in hand with payment dynamics that suit your wants and needs.

That suggests the newly formed interest rates are lower than the previous ones and that you can handle them without compromising your newly formed budget. On the other, if you fail to devise and put a financial plan into action, but solely take the money without previous thoughts on how you are going to spend it wisely, the chances you will pull out the thick end of a bargain are major. The point of taking a loan to cover former loans should be to find a valid solution that would change your current status for the better, not the other way around.

4. Counseling Fees

Albeit a vast majority of financial consultants do not charge for their services on the first meeting, you should not expect them to get involved in your case without counting on financial benefits. Now, if you do your homework and estimate in which ways paying for particular services might be beneficial for your cause, you will easily find out whether hiring a consultant is worth the money they charge.

If they would provide you with a thoughtful and elaborate plan that would help you recover and improve your financial status, then paying them what they ask would be perfectly reasonable. Otherwise, spending huge amounts of money on services you are not sure whether will work or not is something you would like to avoid at all costs.

We should highlight that there is no such thing as a universal financial plan that works for everybody, therefore, you should pick your financial consultants wisely. You can do that by asking around about their proficiency and experience, as well as by intriguing by their success rate so far.

On the other hand, even if they present you with a plan perfectly crafted for your unique cause, it would mean little if you do not stick to it and make reckless financial moves. Therefore, do not forget that you are the one in charge at all times and that no one will care for your finances more than yourself, so you might as well start acting like that.

Hopefully, the aforementioned pieces of information will help you make the right choice when taking debt consolidation loans is in question. It is solely your choice to make, and while careful planning and responsible acting might help you deliver the results, rushing to conclusions might cost you even more than the loan could bring. Thus, borrow responsibly!